Award-winning PDF software

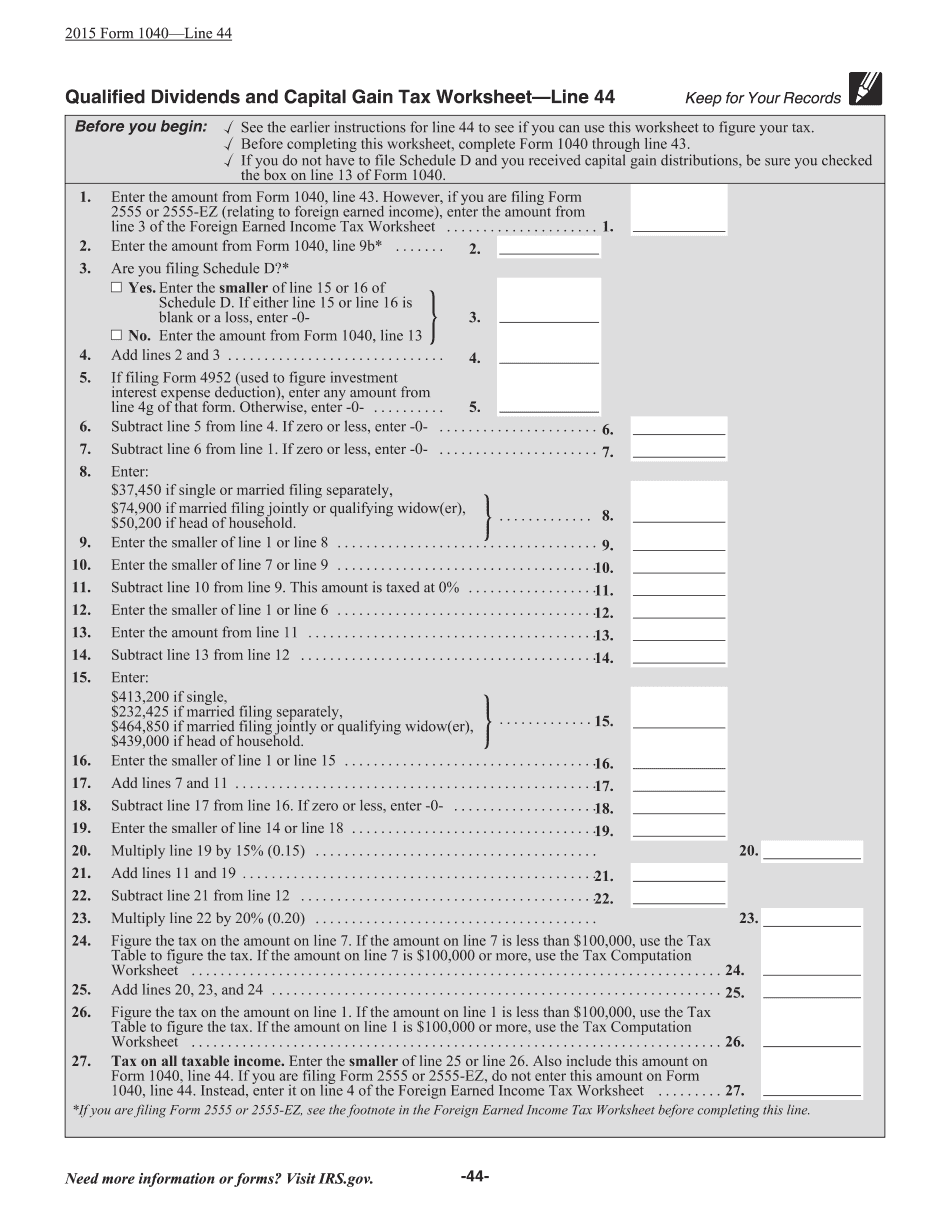

Lakeland Florida Form Instruction 1040 Line 44: What You Should Know

Line by Line Instructions Free File Fillable Forms — Wisconsin Income Tax 2021 Wisconsin Tax Return Filing & Payment Instructions If you will make payments on your federal income tax forms using IRS Direct Pay, make your payments and request a refund of the deposit into your account. After you make the payment, attach an IRS Form 1098 that shows the payment. If you make your payments using the Federal Electronic Fund Transfer (EFT), we won't send you Form 1098, but we will deposit your payment into your account. Make corrections. In Wisconsin, filing fees should not exceed 200 due in advance or 200 each for the three most recent tax years, regardless of your account balance. The payment for the income tax form you are filing will reflect a 200 tax assessment on that form. If not, we will send you an IRS Form 1098 showing the amount you owe. You are not required to pay any late fee, and a 1040 credit will be applied at the end of the tax year. Line 9 — IRS Direct Pay, the system used by most taxpayers to pay federal income taxes via EFT. See Form 1099-SA for information on how to use it. Line 10 — IRS Direct Pay, the system used by most taxpayers to deposit money into an account (via Form 1098), and the amount of credit on the tax return. To prepare Form 1099-SA and obtain the credit, you will need the following information: Your name and Social Security Number; A description of your household and the amount of income and household expenses; What credit you are requesting and its amount; The name and address on the account you are depositing the credit into; Your bank name, account number and routing number. Note: If you're depositing a credit that is greater than the amount shown on your tax return, enter that amount on line 9. If you're depositing a credit greater than the amount on a tax return, you need to enter the full amount on line 9 and the amount of the credit on line 10. Line 18 — All other information for your application that is not related to your EFT payment. 2018 Federal Poverty Guidelines Income Tax Forms Fillable Forms — Washington Income Withholding May 6, 2025 — The 2025 Federal Poverty Guidelines released September 18, 2018, changed your 2025 tax and adjusted gross income for tax year 2018. See the link below to know how your 2025 income tax will be calculated.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Lakeland Florida Form Instruction 1040 Line 44, keep away from glitches and furnish it inside a timely method:

How to complete a Lakeland Florida Form Instruction 1040 Line 44?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Lakeland Florida Form Instruction 1040 Line 44 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Lakeland Florida Form Instruction 1040 Line 44 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.