I'm about to make a lot of people angry other CPA's may hate me for this, but I'm about to give away our IRS trade secrets every day taxpayers paid thousands of dollars to CPA's attorneys and enrolled agents to help them with IRS tax problems more often than not with a basic understanding of how the IRS handles the filing and paying of taxes people can solve their own IRS problems so click the link below and download my free e-book with exact instructions that will never find elsewhere no matter how much money you pay for professional representation this e-book is filled with techniques from my many years of experiences showing you a road map to get you through the system click on it now, or you can listen to more of what I have to say I'm Joe Mariano CPA and after 30 years and thousands of tax cases I know the IRS business like the back of my hand, and I'm so angry that things have gotten so bad in this country that the IRS has beefed up audits and collections people are outraged that the additional taxes they're being charged with and the aggressive actions taken by the IRS to collect them they feel forced to seek professional representation to protect them against our own government knowing this every CPA attorney and enrolled agent has now come out of the woodwork claiming that there are experts and representing taxpayers before the IRS they put up cookie cutter sites all making the same claims of how effective they are we get you every released in the fastest time we lower your taxes the most we have the most offices we have the most clients we have the best Better Business Bureau ready you'll get offered flat...

PDF editing your way

Complete or edit your qualified dividends and capital gain tax worksheet 2021 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export qualified dividends and capital gains worksheet 2021 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 2021 qualified dividends and capital gains worksheet as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your qualified dividends and capital gain tax worksheet 2020 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Instruction 1040 Line 44

About Form Instruction 1040 Line 44

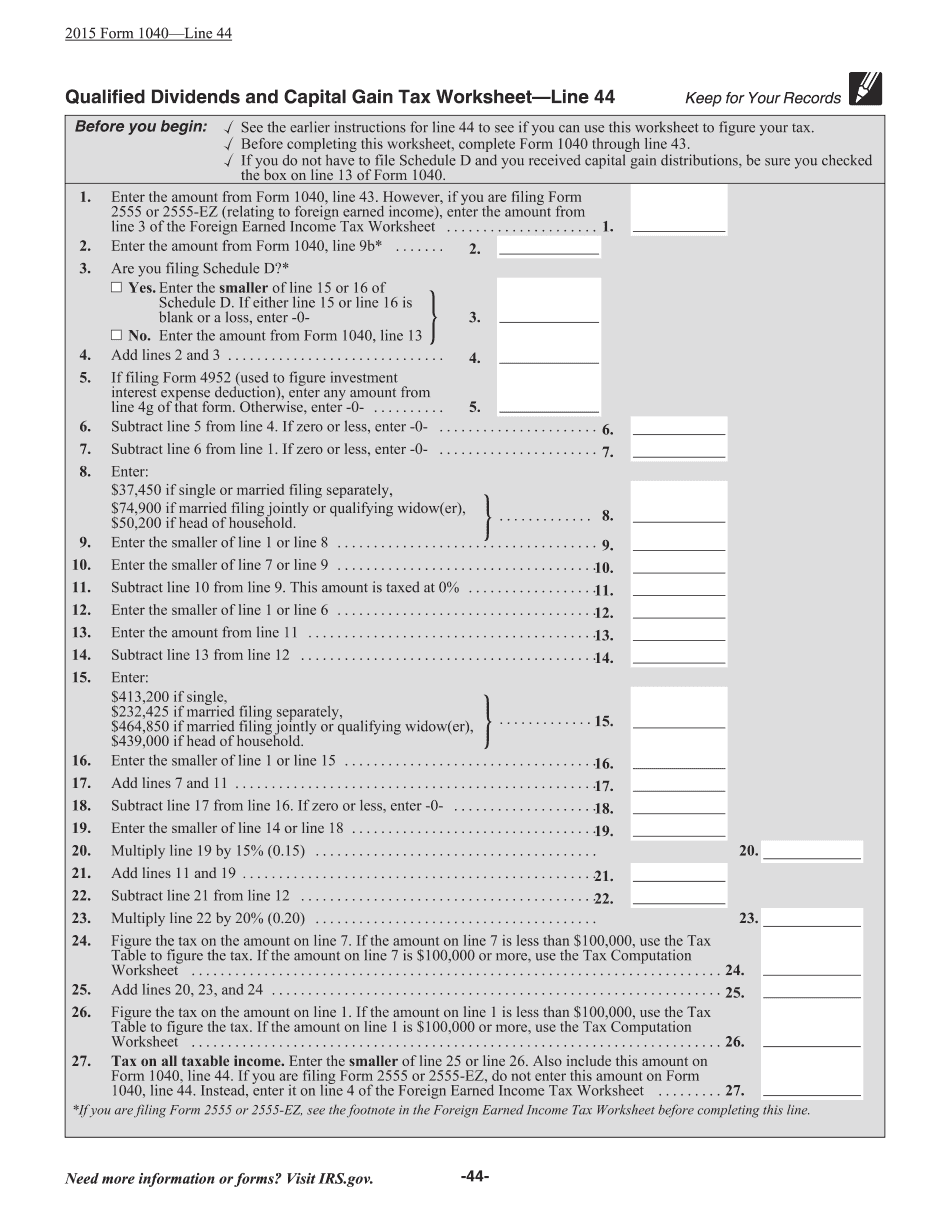

Form Instruction 1040 Line 44 is a line item on the IRS tax form 1040 which refers to the "Tax" section of the form. It specifically refers to the amount of tax owed by the taxpayer, which is calculated based on their taxable income, credits, and deductions. This line is used by the taxpayer to provide the IRS with their final tax liability for the year. Everyone who files a tax return needs to complete Form Instruction 1040 Line 44 in order to determine their final tax liability. Even if a taxpayer does not owe any tax, they must still complete this line to indicate that they have no tax liability. This line is important because it determines the amount of money that a taxpayer owes to the government or the amount of a refund they will receive.

What Is Form Instruction 1040 Line 44

Online technologies help you to organize your document management and increase the productivity of the workflow. Observe the brief guideline to be able to fill out IRS Form Instruction 1040 Line 44, keep away from mistakes and furnish it in a timely way:

How to fill out a Form Instruction 1040 Line 44 online:

-

On the website hosting the document, press Start Now and pass towards the editor.

-

Use the clues to fill out the applicable fields.

-

Include your individual details and contact information.

-

Make absolutely sure that you enter accurate details and numbers in suitable fields.

-

Carefully check out the content of your form so as grammar and spelling.

-

Refer to Help section if you have any issues or address our Support team.

-

Put an digital signature on your Form Instruction 1040 Line 44 printable using the support of Sign Tool.

-

Once document is completed, press Done.

-

Distribute the ready by using electronic mail or fax, print it out or save on your device.

PDF editor permits you to make alterations on your Form Instruction 1040 Line 44 Fill Online from any internet connected gadget, personalize it in keeping with your requirements, sign it electronically and distribute in several ways.

What people say about us

Become independent with electronic forms

Video instructions and help with filling out and completing Form Instruction 1040 Line 44