Award-winning PDF software

Form Instruction 1040 Line 44 Vancouver Washington: What You Should Know

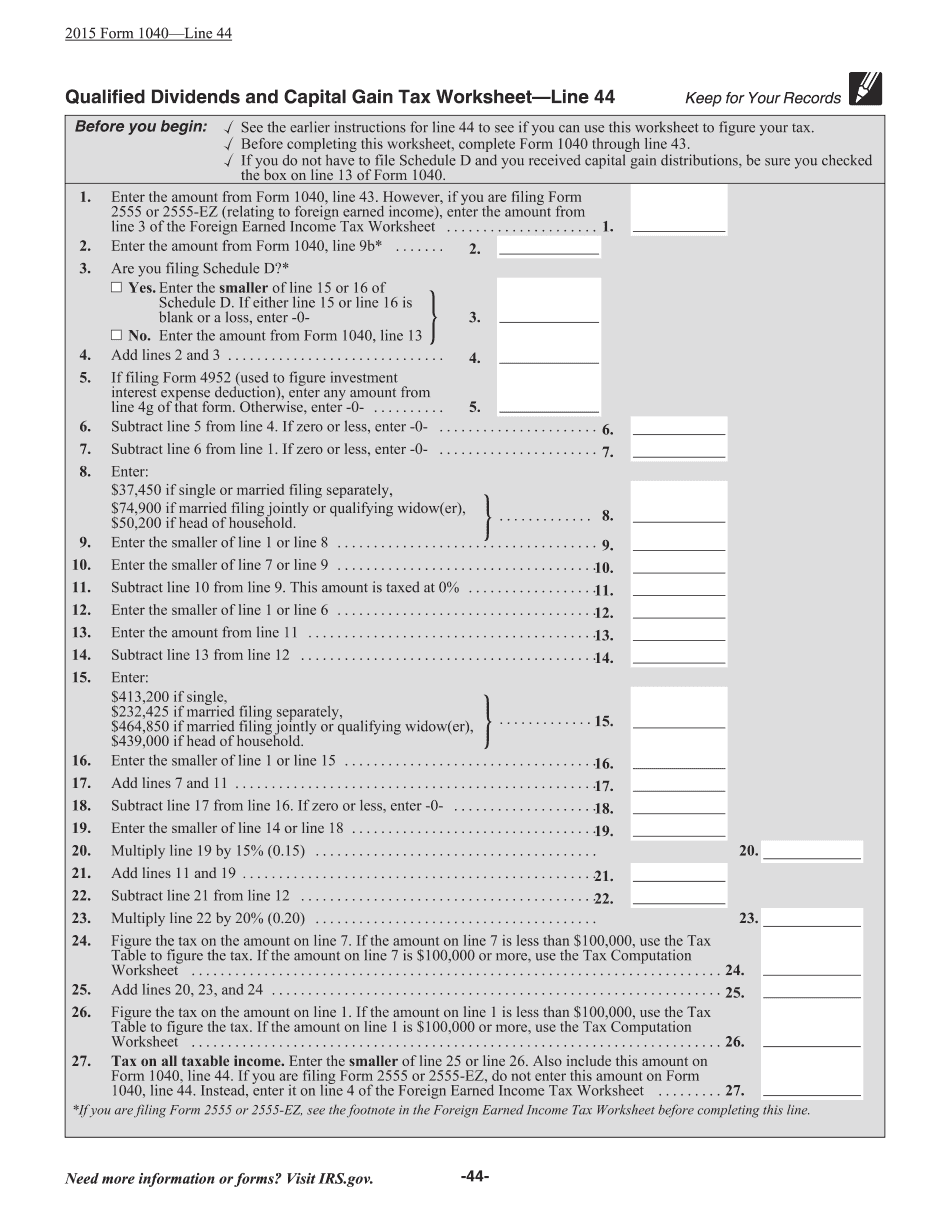

Income tax rates Line 31 — Amounts, deductions, expenses, and credits. Line 32 — Amounts earned and expenses, or credits received, for income, and amounts used by the business. Line 33 — Amounts, credits, and deductions for all sources of income for the year. Line 34 -All net gains and losses for the year. Line 45 — Gross investment income or loss net of gains (or losses) and allowable deductions, if any. Line 48 — Net business income or loss. Line 49 — All income and expenses for the year except: Line 65 -Business expenses other than rental expenses. Line 77 -Business operating expenses. Line 91 -Transactions of the taxpayer's business (i.e. management fee) which are allowable expenses for the year. Line 102 — Loss for business, professional or agricultural activities. Line 105 -Loss for certain other sources of income. Line 110 — Tax on dividend and interest. Line 123 — Capitalized interest and bond interest costs. Line 127 -Interest on certain unearned capital gains. Line 133 -Interest on long-term debt, unless not deductible. Line 135 -Interest, dividend, or return on capital gain. Line 136-Interest on amounts subject to a capital gain dividend (dividends received) or a capital loss (gains or losses from disposal, exchange, or redemption of certain capital assets).[1] Line 139 — Capital gains and losses for prior tax years. LINE 140 — Taxpayers with business interest. Line 141 — Earnings from investment (i.e. profit derived from sale of the business). Line 147 — Taxpayer may deduct only the amount allowed on line 30. Line 151 — Business interest. Line 152 -Other business interest. Line 159 — Taxpayers with business interest deductible in excess of line 151. Line 160 — All other business expenses. Line 171 — Amounts allocable to an insurance business. Line 173 — Amounts allocable to certain property held for investment or sales, but only if it is used for the acquisition, construction, repair, or maintenance of the business. Line 175 [3] -Interest costs paid by the taxpayer on certain amounts not allocable to the operating costs of the business. Line 175 [4] — Interests deductible by other taxpayers under the Income Tax Act, except any amounts to which section 115 limits, or amounts to which this Division applies. Line 205 — Other expenses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 44 Vancouver Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instruction 1040 Line 44 Vancouver Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 44 Vancouver Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 44 Vancouver Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.