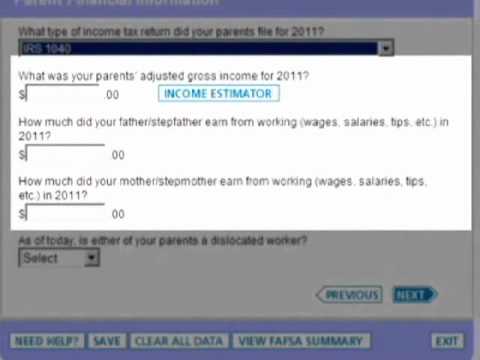

Welcome to the seven easy steps to the FAFSA a student's guide to the Free Application for Federal Student Aid this guide is meant to help you complete the 2012-2025 FAFSA in seven clear and easy to understand steps we recommend you contact your financial aid office with any questions not answered by this tutorial you will hear us refer to the helps and hints box on the right hand side of the screen this can be a valuable tool in answering any follow-up questions you may have during or after watching this tutorial the FAFSA application can be found at WWF FES akov before completing the FAFSA you and your parents if applicable should register for a federal student aid pin at www.pin.ed.gov to complete your 2012-2025 FAFSA you will need your pin number Social Security number driver's license if you have one your 2025 federal income tax return as well as current bank records and any investment in your name if you are required to include your parents information on the FAFSA you will need to have their pin number Social Security numbers 2025 tax return information and any information regarding untaxed income received in 2025 as well as current bank statements and statements for any investments in their name if you are a first time FAFSA filer you'll be required to complete all necessary fields on the FAFSA but if you have previously completed a FAFSA the renewal option will allow you to have certain information prefilled which will expedite the application process please note GRCC deadlines for FAFSA file completion are published online for each semester filing far in advance of the deadline is highly recommended note it's acceptable to estimate income on your initial FAFSA and then update the information when your tax return has...

Award-winning PDF software

1040 line 56 minus 46 negative Form: What You Should Know

Update all income reported on your student loan application. Update an unknown or erroneous debt payment amount on your student loans. How To Correct A FAFSA Question How to Correct Inaccurate Debt Payment Amount How to Correct a Personal Error (An Error) How to Correct an Inaccurate Tax Return Student Loan Repayment Plan — IRS There are a lot of student loan repayment plans available, including Income-Based Repayment Plan, Income-Contingent Repayment Plan, Repayment Plans With Interest Plan, Accelerated Payment Plan and Simplified Overpayments Plan. To find out more about your options, go to the Student Loan Repayment Plan Comparison Chart How To Calculate Your Income Amount to Be Paid To Student Loan Repayment Plan How to Calculate An Income Amount For Student Loan Repayment Plan How to Choose The Right Student Loan Payment Plan For You Student Loan Repayment Plan Examples — Tax Refund Student Loan Repayment Plan Examples — Income-Based Repayment Plan How to Calculate Your Income Amount to Be Paid To Student Loan Repayment Plan — Income-Based Repayment Plan How to Calculate An Income Amount To Be Paid To Your Student Loan Repayment Plan How to Choose the Right Student Loan Payment Plan For You Student Loan Balance Calculation How to Calculate Your Student Loan Balance Student Loan Refinance Calculator How to Calculate Student Loan Interest Amount How to Choose The Right Student Loan Payment Plan For You Student Loan Repayment Plan Calculations Student Loan Repayment Plan Calculation Form Student Loan Repayment Plan Calculator Do you know that there are many benefits available to you after leaving college? After graduating from college, are you interested in going back to school to get another degree, or would you like to start your new career? Are you in medical school or pre-med, or maybe you want to learn an IT skill? If you're interested in a career in the technology industry, or a healthcare or financial management profession, the opportunity to earn money for that career while pursuing a degree in education may offer great benefits. There are many benefits associated with working in these fields, including lower income, higher job security and increased salary. But many of these professionals may not have heard of the Student Loan Repayment Plan.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 44, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 44 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 44 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 44 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 line 56 minus 46 negative