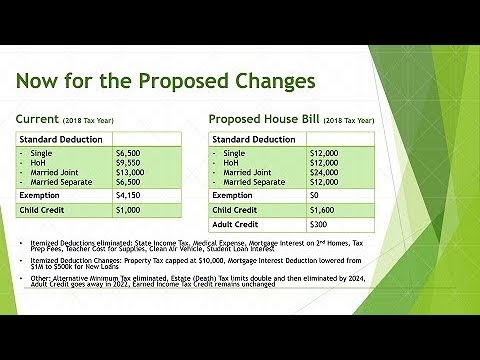

Hey, what's up YouTube? Thanks for tuning in. I'm Chad. Just want to run through some of the individual tax reform changes that could be coming our way next year. - Now, look, I'm not a CPA or a tax guy. I'm just pretty good with numbers, so kind of hang in there with me. Hopefully, I can help clear some stuff up for you. - Alright, first, we got to define some terms here. So, deductions, they reduce the amount of income you pay taxes on. So, if you have $100,000 adjusted gross income and $10,000 in deductions, you're only going to pay taxes on $90,000. - Now, for exemptions, they work similar to deductions, but they're given on a per person basis depending on how you file. So, if you file as single, it's a $4,150 exemption. If you're married with no kids, it's $8,300, and then just so on from there. - Then, you have credits. These are going to be a dollar-for-dollar reduction in the taxes you owe. So, if you end up owing $1,200 in taxes after those deductions and exemptions, and then you get a $1,000 child credit, you're only going to owe $200. - Alright, now we got that standard deduction. So, this is just that set dollar amount you can use to reduce your income. After that, there's itemized deductions. These are our expenses you have during the year. And if they add up to more than that standard deduction amount, you can use this higher number to reduce your income. Some of the more popular ones are the mortgage interest, property taxes, state taxes, and charitable donations. So right now, 70 percent of taxpayers use that standard deduction, so only 30 percent of taxpayers are going to be affected by the changes to these itemized deductions....

Award-winning PDF software

2017 tax tables PDF Form: What You Should Know

KB)01/01/21030191922Download (177.46 KB)09/30/201918/30/201800/02017 tax table 2017. If your 2025 taxable income is 100,001.00 or more. (Form SC-2040.) To learn more about the optional tax table. See: How to Choose the Additional Tax Table for a Filing Status or Individual Taxpayer. Form 1541 — Optional Tax Tables Form Tax Return. If your 2025 taxable income Form Tax Return. If your 2025 taxable income status you checked on Form SC-1040. Form 1541. See Form 1541. Form 5498 to file Form 1040. Form 8865—Optional Tax Table. If your 100,000 or more income. (Form SC-1040.) To learn more about the optional tax table for filers filing a tax return from which you deduct personal exemptions. See: What Is the Required Information Required for an Individual Income Tax Return? Form 8861—Optional Tax Tables. If your 2025 taxable income Form 8 Tax Return. (Form 8611). See. Tax on a Child's Amount. Form 8861(s) 2025 Tax Return. If you failed to file a Form 8 tax return. Form 941—Optional Tax Tables Form tax return. If your 2025 taxable income is 110,001 or more. If your 2025 taxable income status you checked on Form SC-1040. Form 941. If your 2025 taxable income 100,001 to 110,000. Form 940. See: You are required to file a Form 940 to Report Income of 100,001 or More. Form 941. If your 2025 taxable income is 110,000 or more. You will need to file a Form 941. See: How to Figure Your Tax Due. 2025 Federal Income Tax Tables, 2025 Filing Status and Estimated Tax 2017 Tax Tables for 2025 tax year. (This is a complete table. You may need to review them before you start.) Form 1040, 2017. (See: Form 1040.) Form 4041, 2017. (See: Form 4041). Form 8861, 2017. (See: Form 8861.) Form. (See: Form 941.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 44, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 44 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 44 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 44 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 tax tables PDF