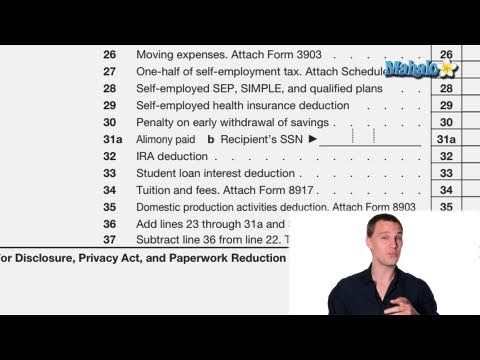

Hey everyone, it's John, your personal tax consultant with a degree in accounting. So, you've got your gross income figured out, and now we move on to adjusted gross income. There are a certain number of deductions that you may be able to take to reduce your taxable income, which will then, in turn, reduce your tax obligation for the year. Some good examples of this include a health savings account deduction. If you made a contribution to a health savings account, that amount might be deductible. There's also a possible deduction for moving expenses if you're required to move houses, whether it be out of state or to a new city for a job. Some of those moving expenses might be deductible. Another potential helpful deduction is the self-employed health insurance deduction. You may be able to deduct the entire amount that you pay for yourself and 35 percent of the premiums you pay for your employees. For you students out there, there's a potential deduction for tuition and fees. Now, for more information on this deduction, as well as a potential tax credit for students, click on the link above and watch the video. Once you've determined all the deductions you qualify for, add them all up, subtract that number from your gross income, and you come up with a number we like to call your adjusted gross income, otherwise known as your AGI. Thanks for watching! For other tax-related videos, feel free to follow the link below or any of the links above. And be sure to rate, comment, and subscribe to our channel. If you have any requests or suggestions, send us an email to request at Mahalo com. Thanks, you.

Award-winning PDF software

1040 line 10 Form: What You Should Know

You are no longer eligible for the married filing separately exemption. The 9,000 limit does not apply to the joint federal return. May 6, 2025 — You may have additional tax to claim for the following, depending on your adjusted gross income. Taxes paid for 2016. Taxes paid for 2017. The IRS Form 1040, U.S. Individual Income Tax Return, is a two-page document used to report tax-related information on Form 1040-ES. Taxes paid on 2025 federal income tax return. (Note: Some of these are separate IRS taxes, and you should check with your state or local tax authority if you have additional state income tax.) What Is Form 1040, U.S. Individual Income Tax Return? — TurboT ax May 12, 2025 — The form 1040 is an online application that requires a credit check, and your Social Security Number (SSN) to be included on your tax return. A form 1040 is also a paper application. A copy of Form 1040 and any supporting information must be sent to the IRS immediately after filing your return. The form is and requires a credit check, and your Social Security Number (SSN) to be included on your tax return. A IRS Form 1040 is a two-page document used to report tax-related information on Form 1040-ES. The IRS Form 1040 does not have an Income category and does not have brackets to help you determine your filing status. What Is IRS Form 5471? — TurboT ax June 28, 2025 — The form 5471 is an electronic notice that will be sent to your address on file with the Social Security Administration (SSA). It must be received no later than the time a tax return must be filed based on the IRS Form 1040 or 1040-ES forms. If you don't receive a Form 5471, contact the SSA to discuss the issue. What Is IRS Form 8822.5? — TurboT ax May 10, 2025 — The TurboT ax IRS form 8822.5 is used to file an ITIN with the IRS. These are Taxpayer Identification Numbers (Tins) for individuals who do not file an income tax return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 44, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 44 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 44 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 44 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1040 line 10